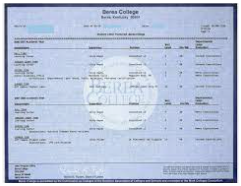

California CPA certificate, CAL CPA license

The California CPA Certificate is not merely a license; it is a symbol of top professional competence in the global accounting field, especially in the US market. #Buy California CPA certificate online. Its functions are mainly reflected in aspects such as career development, professional authority, salary returns, and global mobility.

Career Development and Opportunities: Open up the path to senior positions such as Chief Financial Officer and Financial Director; The career path is broader, allowing one to venture into industries like auditing, taxation, consulting, and finance. Buy CPA certificate online.

Legal and professional authority: Has the right to sign audits and can issue legal audit reports; Represents the client in negotiations with the US Internal Revenue Service.

Salary and rewards: Significantly increase salary levels and career ceilings. #Order CAL CPA license. It is the “passport” for promotion to senior management positions.

Global Recognition and Liquidity: The American CPA enjoys a high reputation in the global business community; it is particularly valuable in the fields of multinational enterprises and US-listed companies.

In California, two concepts need to be clearly understood:

1. CPA Certificate (Certificate): After you pass the comprehensive examination and meet the basic educational requirements, the California State Board of Accountancy will issue this certificate. It indicates that you have passed the exam, but does not grant you the right to practice.

2. CPA License (License): After obtaining the certificate, if you also meet the additional work experience requirement (usually one year of work experience under the supervision of a certified CPA) and complete the ongoing professional ethics training, you can apply to become an Active License Holder. Only active license holders have the aforementioned auditing signature rights and all professional rights.